Buying your first home is a big milestone, and doing it in a fast-growing city like Phoenix can feel overwhelming. This guide will walk you through what to expect and how to prepare.

-

Get Your Finances in Order:

Check your credit score, pay down debts, and save for a down payment. Lenders often require proof of financial stability before approving a mortgage. -

Understand the Market:

Phoenix is a seller’s market, meaning homes sell quickly. Be prepared to act fast when you find a home you love. -

Consider Assistance Programs:

Arizona offers various down payment assistance programs for first-time buyers. Look into state grants and low-interest loans. -

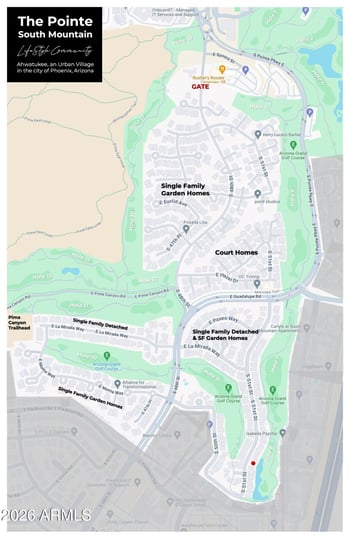

Hire a Local Agent:

Phoenix neighborhoods vary widely in price, amenities, and future growth potential. A local agent can help you find the best fit. -

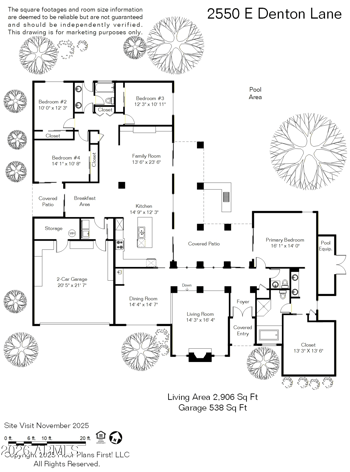

Get a Home Inspection:

With Arizona’s unique climate, it’s important to check for roof damage, HVAC efficiency, and sun exposure issues before finalizing your purchase.

Buying a home in Phoenix is an exciting investment, especially as the city continues to grow and attract new residents.